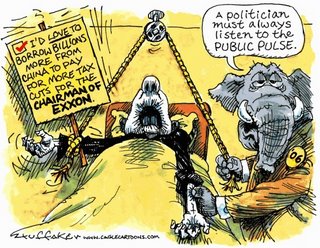

Not just estate tax where GOP has "No Shame"

Sandy Huffaker’s image from MSNBC’s Cagle Syndicate appears above (assuming Blogger isn’t still being contrary, that being the main reason I’ve been slack in posting lately) but was prompted by the Anniston Star’s Editorial of today entitled “Shame on the GOP”. How the Republican Party is handling the estate tax is I think as revealing as anything they’ve done. The party of “family values” is at least looking out for the Walton (Wal-Mart) family!

Sandy Huffaker’s image from MSNBC’s Cagle Syndicate appears above (assuming Blogger isn’t still being contrary, that being the main reason I’ve been slack in posting lately) but was prompted by the Anniston Star’s Editorial of today entitled “Shame on the GOP”. How the Republican Party is handling the estate tax is I think as revealing as anything they’ve done. The party of “family values” is at least looking out for the Walton (Wal-Mart) family!Although I’d argue the party of arguably our greatest President Abraham Lincoln has generally favored the powerful over the weak, the words of Theodore Roosevelt in his famous “New Nationalism” speech from back in 1910 resonate with me. Although this speech is worth reading on a variety of issues, TR’s thought on taxation might be distilled as follows:

No man should receive a dollar unless that dollar has been fairly earned. Every dollar received should represent a dollar’s worth of service rendered—not gambling in stocks, but service rendered. The really big fortune, the swollen fortune, by the mere fact of its size, acquires qualities which differentiate it in kind as well as in degree from what is possessed by men of relatively small means. Therefore, I believe in a graduated income tax on big fortunes, and in another tax which is far more easily collected and far more effective—a graduated inheritance tax on big fortunes, properly safeguarded against evasion, and increasing rapidly in amount with the size of the estate.The estate tax issue has rightly been labeled as the “Paris Hilton Benefit Act” and as E.J. Dionne, Jr. points out the amount of money is amazing, especially considering our deficit, plus the limited amount of people affected by the tax is minimal. Dionne writes,

My understanding is that only a few wealthy families will pay the vast majority of estate taxes. Worries over losing the family farm are false fears. In Alabama, estimates are that forty nine estates would need to file estate tax returns in 2009 if the tax were to apply to wealth over $3,500,000.00. I recall Jeff Sessions attempting to use the destruction of Katrina to find victims of what the Rove Republicans have tried to label the “death tax”. That Senator Sessions defended his “legislative ambulance chasing” by declaring the estate tax as “immoral” reveals much about Jeffy B and the ReThuglicans.With so many other taxes around, it's hard to understand why this is the one Congress would repeal. It falls, in effect, on the heirs to the wealthiest Americans. Fewer than 1 percent of the people who died in 2004 paid an estate tax, and half the revenue from the tax came from estates valued at $10 million or more.

Yet, because the wealthy have gotten wealthier over the past three decades or so, the estate tax produces a lot of money. Counting both revenue losses and added interest costs, complete repeal of the estate tax would cost the government close to $1 trillion between 2012 and 2021, according to the Center on Budget and Policy Priorities.

Additionally, I had two semesters of “tax law”, which I admittedly loathed, yet even I learned all sorts of estate planning techniques. Few “regular folks” have to pay any estate tax if they’ll do a minimal amount of planning. Via charitable trusts, Q-tips, gifting out, … the average low millions estate will simply not be raided by the treasury. For politicians like Jeff Sessions and other GOP operatives to continually suggest this will occur shows they are simply liars! For a large majority of Americans and Alabamians to fall for the lies shows they are fools! If a person says estate taxes are wrong policy on principle then we’ll talk but don’t just lie about who might suffer under this most Progressive of taxes.

Warren Buffet and Bill Gates and … know much of what yields wealth is where you start and also how society assists the accumulation of wealth. David Francis of The Christian Science Monitor reports in “It Takes a Village to Raise a Millionaire” that

Tremendous resources that I’ve located just this morning are Responsible Wealth and United for a Fair Economy. It does my heart good to see wealthy people and plain old regular folks that follow the traditions of Progressivism that Republican Theodore Roosevelt knew were moral and wise. Here’s hoping the Republican Party can return to some measure of reasonable action. Concentration of wealth is not conducive to a democratic society nor is it a good value.Unfortunately, their prospects of reaching the top of the economic ladder are fading in the United States. It's becoming a nation of more rigid inequality, starting at childhood. That, anyway, is the conclusion of some recent research.

A new report by Ms. Lui's United for a Fair Economy (UFE), a liberal advocacy group based in Boston, done in conjunction with an affiliate, Responsible Wealth, finds that economic success usually depends on help from society, and often more on wealth and privilege than talent and dedication.

For instance: Almost a third of the Forbes 400 richest people were born onto that list, with an average net worth of $2.6 billion. Another quarter inherited a small business, oil lands, or perhaps had well-to-do parents able to provide an expensive education and family friends helpful in a business career.

Meanwhile, income mobility between generations has been falling, concludes Bhashkar Mazumder, an economist at the Federal Reserve Bank of Chicago, in a 2003 paper. Most children of rich parents stay rich, and children of the poor stay poor. When compared to Canada, Finland, and Germany, the US stands out for "its relative lack of mobility," he says.

That implies that the increased inequality in incomes in the US in the past few decades, "is likely to remain a feature of the US economy for some time," he adds.

Such conclusions are troubling for a culture that for so long has believed in the self-made man and woman

Few Republicans on the national stage today are speaking this language. They aren’t welcome to do so perhaps? If they wish to speak out and can’t without consequences, then the Democratic Party, or even third party options, would likely welcome them. I think many reasonable people are fed up with a GOP that is based upon power and spin and discipline and manipulation and dirty tricks and … I know I ran across a Digby post that pointed out that many young activists cannot recall a less partisan time. Digby’s description of the GOP’s “scorched earth” style is accurate. I value and agree with his line of “But the modern Republican party must undergo fundamental internal change before it can be trusted.”

I know I’ll have a hard time trusting anyone that enables the direction our nation is moving. I’m fed up with the Fundamentalism and Corporatism and Neo-Conservative aggression and … I’ve closed nearly every post with something I believe, that being “Peace … or War!”. I’m always seeking peace but until there’s a genuine effort to have peace I’m going to stay in war mode with the Bu$hCo (Rove, DeLay, …) version of the GOP.

I’m not going to engage in Atwater/Rove style politics such as swift boating and the like as I’ll try to seek facts and reason and compassion as my foundations but I’ll fight for Progressives and against the modern Conservative movement. As Digby said, “We can beat them on the field of ideas. But we have to engage.” I too long for rational Republicans to take their party back. If and when you do, I’ll be ready for bi-partisanship as I think will be true for many on my side of the divide. Progressives/liberals want our society to advance so we’ll always default to working together yet I think plenty are learning how to fight. This estate tax stunt has shown where the GOP is trying to take our country. They’ve lost the benefit of the doubt and to trust them is foolish and counter-productive.

I appreciate how our Anniston Star routinely provides us a voice of reason here in Alabama. This coverage of the estate tax issue is so valuable, especially when Alabama has bought the “every tax is a bad tax” mentality. I’m afraid however there is little reasoning with the leadership of the Republican Party. They have no shame. Peace ... or War!

<< Home